Only the beginning: United posts $2.1 billion loss for Q1

United Airlines just provided a grim preview of their losses for Q1 (January 1 - March 31, 2020): $2.1 billion. Adjusted earnings were "just" $1 billion in losses, but that was still far worse than the $378 million loss forecast by analysts surveyed by Refinitiv. Their Q1 revenue was down by "only" 17%, due to the fact that the COVID-19 pandemic effect didn't really hit until the end of February. However, United has stated that air traffic demand is currently at "essentially zero", painting a chilling yet expected future outlook.

For the months of May and June, the carrier has already cut over 90% of their flights. Existing flights have a passenger usage rate averaging just 13%, meaning that most flights are operating at a significant loss. United has attempted to reassure investors and the public that it's still backed by $6.3 billion in cash, with $5 billion in federal grants and low interest loans to draw from as part of the federal bailout package.

Where does United go from here?

Though their Q1 were an absolute nightmare, it was expected and is likely only the peak of the iceberg. If it's any consolation, all the other carriers will likely post similar losses for Q1. United has done what it can by substantially scaling back their network, grounding most of their fleet, and furloughing employees, but these are all band aids when air traffic demand is sitting at virtually zero and you're still flying widebody planes at 13% capacity. Q2 might as well be the worst quarter in history for all the carriers, and the feds will likely need to act again to save them from dissolution.

Quick thoughts

Like many of the travel corporate players, United's stock has nosedived 70% over the past 3 months. Unfortunately during this trying time, the future looks just as grim, and it'll likely take years for them to recover. I do feel for the airlines as the utter collapse in travel demand was definitely no fault of their own. But if they're going to be taking out interest-free loans at the expense of taxpayers, then they should also do their part by preserving employee jobs and honoring flight refunds for customers.

|

| United's grounded planes at Cleveland Hopkins International Airport |

For the months of May and June, the carrier has already cut over 90% of their flights. Existing flights have a passenger usage rate averaging just 13%, meaning that most flights are operating at a significant loss. United has attempted to reassure investors and the public that it's still backed by $6.3 billion in cash, with $5 billion in federal grants and low interest loans to draw from as part of the federal bailout package.

|

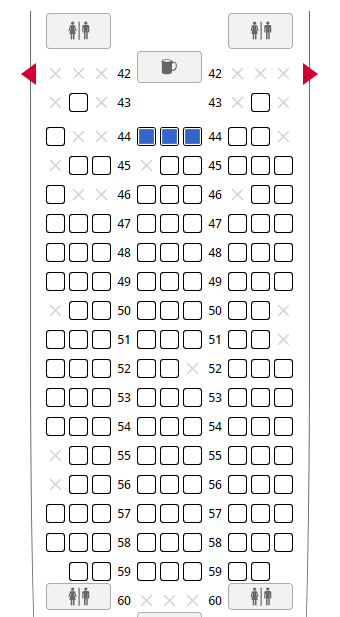

| United's B787-10 economy class seat map for this morning's SFO-EWR flight |

Where does United go from here?

Though their Q1 were an absolute nightmare, it was expected and is likely only the peak of the iceberg. If it's any consolation, all the other carriers will likely post similar losses for Q1. United has done what it can by substantially scaling back their network, grounding most of their fleet, and furloughing employees, but these are all band aids when air traffic demand is sitting at virtually zero and you're still flying widebody planes at 13% capacity. Q2 might as well be the worst quarter in history for all the carriers, and the feds will likely need to act again to save them from dissolution.

Quick thoughts

Like many of the travel corporate players, United's stock has nosedived 70% over the past 3 months. Unfortunately during this trying time, the future looks just as grim, and it'll likely take years for them to recover. I do feel for the airlines as the utter collapse in travel demand was definitely no fault of their own. But if they're going to be taking out interest-free loans at the expense of taxpayers, then they should also do their part by preserving employee jobs and honoring flight refunds for customers.

From all of us at Flying for Fitness, please stay healthy during this trying time. We hope you enjoyed this post. Please consider visiting one of our sponsors by clicking on the advertisements. Our sponsors pay us for customer visits and help us to keep the lights on. Thanks!

Comments

Post a Comment