Did I get a retention offer for the Amex Gold card?

The Amex Gold card is hands down the best card for anyone who eats (aka everyone) as the card earns 4x Membership Rewards (MR) at U.S. supermarkets and restaurants worldwide. MR can really add up, and the card also comes with an annual $100 incidental airline credit and $120 for dining at select establishments that help offset the hefty $250 annual fee. As my annual fee was charged near the of May, I decided to call Amex customer service to see if I could get a retention offer.

Amex retention offers background

Amex allows you to cancel your card for a full refund of the annual fee provided that you cancel within 30 days of the annual fee being charged. Previously, if you canceled the card mid-year, Amex would give you a pro-rated refund of the annual fee. For example, if you canceled 6 months after the $250 annual fee was charged, you'd get a $125 refund. But now, Amex no longer offers pro-rated annual fee refunds. So if you cancel after 30 days of the annual fee charge, you'll be stuck with the entirety of the fee.

Amex is known for handing out retention offers every other year provided that you use their card frequently. The retention offers come in the form of either MR or statement credits, either automatically or after spending a certain threshold within a defined time period.

1st call with Amex

I first called Amex about a week after my Gold card's $250 annual fee was charged. The agent transferred me to the cancellation department, which now handles all the retention offers. I was told that there were no retention offers for me at this time. This came as no surprise since I was offered a retention offer last year, and Amex typically only grants retention offers every other year. I confirmed with the agent that I would have 30 days to cancel the card for a full refund of the annual fee.

2nd call with Amex

About a week later, I decided to give the retention line another shot. This time when I called, I wasn't transferred to the cancellation department. The agent but me on a brief hold, and then came back and said that I was eligible for one of two retention offers:

- 10,000 automatic MR

or

- $75 statement credit after spending $500 within 3 months

This one was a no brainer for me as I value MR well over a penny each, so the 10k MR is easily worth $100+. Additionally, I wouldn't have to spend a single penny to get the 10k MR retention offer; I would just have to retain the card. So I immediately told the agent that I would like the 10k MR offer, and he spelled out the terms and conditions and I agreed. The Amex MR can take up to two billing cycles to post. But after a few business days, I already saw that the bonus 10k MR had been added to my Amex Gold account.

Bottom line

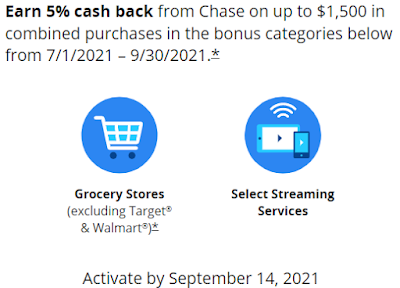

Unlike Chase, which has offered bonus categorical cashback during the COVID-19 pandemic, Amex has not been on many people's good lists recently. By refusing chargebacks for plane tickets that were canceled by the airline and by clawing back airline incidental credits and MR, Amex has not been generous at all during the pandemic. However, I was happily surprised to be given a nice retention offer on my second call. Amex typically only hands out retention offers every other year, so it was great to receive retention offers in back-to-back years. This also serves as evidence that you shouldn't give up after your first call, as I wasn't given a retention offer until the second call.

From all of us at Flying for Fitness, please stay healthy during this trying time. We hope you enjoyed this post. Please consider visiting one of our sponsors by clicking on the advertisements. Our sponsors pay us for customer visits and help us to keep the lights on. Thanks!

Comments

Post a Comment