My experience using the Costco Citi Visa's purchase protection benefit

What is purchase protection?

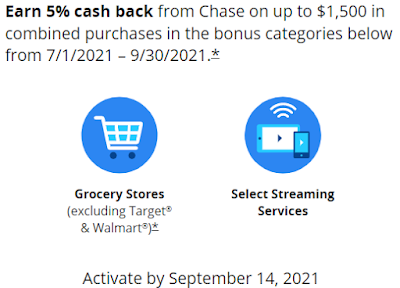

Purchase protection typically covers accidental damage and theft of your purchase with your eligible credit card. For Amex, this coverage extends for 90 days from the date of purchase, and 90 or 120 days for Citi depending on the card, and 120 days for Chase. Coverage limits can be anywhere from $500 for no and lower annual fee cards like the Chase Freedom to up to $10,000 for premium cards like the Chase Reserve and Amex Platinum. The following documentation is usually required to file a claim:

- Itemized receipt of your purchase

- Credit card billing statement reflecting the purchase

- Photos of the damaged item(s)

- Repair or replacement estimate

- Police or incident report (theft claims)

Purchase protection is usually underwritten by a third party insurance company. For example, Chase is covered by Indemnity Insurance Company, Citi by Virginia Surety Company, and Amex by AMEX Assurance Company. Most purchases are covered, with the following common exceptions:

- Items that mysteriously disappear with no evidence of a wrongful act

- Antiques and collectible items

- Currency, cash (including rare or precious coins), gift cards, Traveler’s checks, and tickets of any kind

- Items with a limited life span like food, perfume, light bulbs, batteries, etc.

- Animals and living plants

- Boats, automobiles, aircraft and any other motorized vehicles

- Items purchased for resale, professional, or commercial use

Before making a purchase where you feel that purchase protection may come in handy, such as a bicycle or cell phone, it's a good idea to check with your card issuer to ensure the coverage terms and limits. Also, keep in mind that purchase protection will only cover up to the amount you actually paid with the card. For example, if you purchase a $200 bicycle on Amazon with a $100 Amazon gift card and $100 with a Citi card, and the bicycle gets stolen within the first month, then Citi will only reimburse you $100 because that's how much you spent on the card for the bicycle.

Filing a claim

I had purchased an indoor cycle bike (aka spin bike) with my Citi Costco Anywhere Visa card. Even though the purchase would have only earned me a measly 1% cashback, the Costco Citi card offers the best extended warranty coverage out of all credit cards, and purchase protection is good for up to 120 days. The spin bike, which came with a 30-day money back guarantee, just happened to break 35 days after the purchase. I applied too much pressure on the resistance knob, so the stopping mechanism gave out. And the only way to fix and and operate the resistance on the spin bike was to purchase a new resistance knob. Replacement part costs can run high for exercise equipment, and the resistance knob was no exception for such a simple part.

After purchasing and installing the resistance knob, I filed a purchase protection claim with Citi. Citi has a PDF form that you can fill out and conveniently e-mail to them with your supporting documentation, which were the billing statement reflecting the purchase, pictures of the broken and replacement part, and repair estimate receipt. One business day after my first submission, Citi replied stating that they needed a full picture of the spin bike (not just the broken and new parts) and an itemized receipt (not just the billing statement). So I e-mailed clarified pictures and an itemized receipt of the spin bike to Citi. Two business days later, Citi replied with the following message:

Your claim under the Damage and Theft Purchase Protection program has been approved.

A payment in the amount of $XX.XX, which represents the full amount payable for this claim, will be credited to your card account within 1 to 2 billing cycles.

A payment in the amount of $XX.XX, which represents the full amount payable for this claim, will be credited to your card account within 1 to 2 billing cycles.

And after just one business day (not billing cycle), I saw that the money had been refunded to my Citi account online. So from the time of submission to the time of refund was just 4 business days, and that's including the delay that arouse due to the initial incomplete claim submission.

Bottom line

Like their Worldwide Car Rental Insurance, which is now a benefit afforded to only their Costco card, Citi hit the mark on this one. Submitting a claim is simple and easy over e-mail, and the turnaround time is fast. When it comes to purchases prone to accidental breakage or theft, such as electronics, appliances, jewelry, stoneware, and recreational equipment, it's a good idea to use the card that gives you the best and longest purchase protection. For example, the Chase Reserve not only affords 120 days of purchase protection, but also includes up to $10,000 per incident as opposed to $1,000 per incident for the Costco Citi. So for big purchases such as engagement rings, you'd want to turn to the Chase Reserve even if it doesn't provide the best cashback for the purchase.

From all of us at Flying for Fitness, please stay healthy during this trying time. We hope you enjoyed this post. Please consider visiting one of our sponsors by clicking on the advertisements. Our sponsors pay us for customer visits and help us to keep the lights on. Thanks!

Comments

Post a Comment