Chase Freedom and Unlimited offering $200 signup bonus + 5% cashback on groceries

Both the Chase Freedom and the Unlimited cards have upped their sign-up bonuses to $200 (20,000 Ultimate Rewards points) after spending $500 in the first 3 months and tagged on 5% cashback on grocery store purchases for the first 12 months of card membership! This is an excellent sign-up bonus for these no annual fee cards: the Chase Freedom which earns 5% on quarterly rotating categories and the Chase Unlimited which earns 1.5% on all purchases. The 5% cashback applies on grocery store purchases is capped at $12,000 for the 12 months, and is for the new cardholders only. Let's take a look at the two cards.

- $200 (20k UR) after spending $500 in the first 3 months of card membership

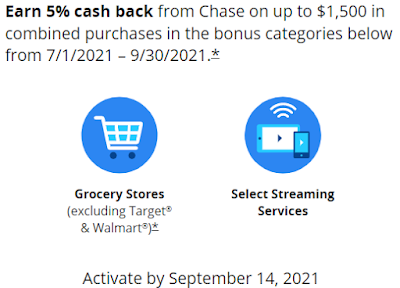

- 5% cashback on quarterly rotating categories, up to $1,500 in purchases

- For Q3 (July-September), 5% cashback on all Amazon and Whole Foods purchases

- 5% cashback on all grocery store purchases (not including Target or Walmart) for the first 12 months of card membership, up to $12,000 in purchases

- 1% cashback on all other purchases

- 0% Intro APR for 15 months from account opening on purchases

- No annual fee

- $200 (20k UR) after spending $500 in the first 3 months of card membership

- 5% cashback on all grocery store purchases (not including Target or Walmart) for the first 12 months of card membership, up to $12,000 in purchases

- 1.5% cashback on all other purchases with no limit

- 0% Intro APR for 15 months from account opening on purchases

- No annual fee

Chase Ultimate Rewards vs. cashback

Both cards earn cashback in the form of Ultimate Rewards (UR), which can be redeemed for statement credits at 1 cent per point. However, if you also have an annual fee Chase UR credit card like the Chase Ink Preferred, Chase Sapphire Preferred, or the Chase Reserve, you can convert the points over to the annual fee card and in turn transfer them to airline and hotel loyalty points. In addition, Ink Preferred and Sapphire Preferred points can be cashed out at 1.25 cents each and Reserve at 1.5 cents each. So the sign-up offer of 20k UR is worth at least $300 if you also have the Chase Reserve card.

Which card is right for you?

In order to be eligible for the Freedom or Unlimited, you must not have received a new cardmember bonus for the card that you're applying for in the past 24 months. And like all Chase cards, the Freedom and the Unlimited are under Chase's dreaded 5/24 rule, which means that you won't qualify if you have opened 5 or more credit cards in the past 24 months with any and all financial institutions.

If you're not under 5/24 and haven't received a sign-up bonus for the card, then you can apply for either or both cards. The difference between the two cards is that with the Unlimited, you get 1.5% cashback on all purchases, whereas the Freedom gets 5% on quarterly rotating categories, and 1% cashback on all other purchases. In the past, the Chase Freedom's categories often include department stores, wholesale clubs, home improvement stores, gas, streaming services, travel, etc. So if you do spend in these categories, then the Freedom may be right for you. But if you're more of a generalist with varied spending, then you may want to consider the Unlimited.

Bottom line

These are great sign-up offers for both the Chase Freedom and Unlimited cards. These are some of the best no annual fee cards on the market, and it's great to see not only increased sign-up offers but also 5% cashback at grocery stores for the first 12 months and 0% interest APR for the first 15 months. If you're not under 5/24 and have an annual fee Chase UR card like the Sapphire, then I would highly recommend signing up.

From all of us at Flying for Fitness, please stay healthy during this trying time. We hope you enjoyed this post. Please consider visiting one of our sponsors by clicking on the advertisements. Our sponsors pay us for customer visits and help us to keep the lights on. Thanks!

Comments

Post a Comment